Stock Market Commentary

For the week of January 4, 2010

The Market

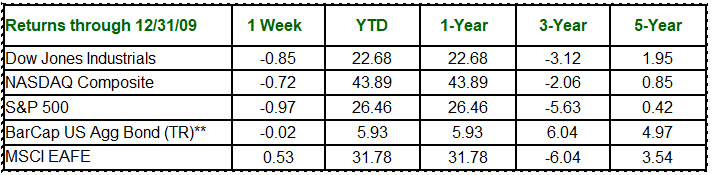

After two years of negative returns, U.S. equity markets ended 2009 with their highest gains since 2003. The S&P gained 26.46 percent for the year compared to a loss of 38.5 percent last year, rebounding 65 percent after hitting a 12-year low on March 9. For the fourth quarter, the Dow gained 7.5 percent, the S&P gained 5.5 percent and the NASDAQ gained 6.9 percent. For the four-day holiday week, the Dow lost 0.85 percent to close at 10,428.05. The S&P fell 0.97 percent to finish at 1,115.10, and the NASDAQ declined 0.72 percent to end the week at 2,269.15.

Retail Sales A-Leaping – Initial reports on holiday retail sales show a 3.6 percent increase from Nov. 1 to Dec. 24, a much brighter story than the 3.2 percent drop in the same period in 2008, according to MasterCard Advisors’ Spending Pulse. Adjusting for the extra shopping day between Thanksgiving and Christmas 2009, sales gains were closer to 1 percent. Online shopping, however, leapt 15.5 percent for the season, compared to a year ago, although it accounts for only 10 percent of total retail sales. (Source: USA Today)

$100 Butter – If grocery prices had risen at a comparable rate to health care since the 1930s, consumers would currently be paying $107.90 for a dozen oranges, $24.20 for a roll of toilet paper, $64.17 for a pound of coffee and $102.07 for a pound of butter. (Source: American Institute for Preventive Health, Blue Cross and Blue Shield Association)

Green Taxes – States are increasingly looking to save money by cutting back on distributing paper income tax forms and encouraging electronic filing. Mississippi has become the second state (after New York) to completely discontinue mailing tax forms at an estimated savings of $90,000 annually. California has stopped mailing forms to non-residents and part-year residents, saving more than $259,000. Kansas has cut distribution of forms at libraries and grocery stores and some instruction forms will be available only online, saving $710,000. According to the IRS, of the 141 million returns filed in 2009, more than 67 percent were filed electronically, compared to 59 percent in 2008. (Source: USA Today)

WEEKLY FOCUS – Beware 2010 Retroactive Tax Resurrection

A Forbes website article posted the final day of 2009caught our eye this week: When the U.S. Senate recessed for the holidays, its members left 50 tax breaks to expire at the end of the year. The House on Dec. 9 had passed a bill extending most of the breaks (but notably not the alternative minimum tax or AMT), but the Senate never addressed its similar measure. On Dec. 29, with less than three days remaining in the year, Senate Finance Committee Chairman Max Baucus (D-Mont.) and Ranking Member Charles Grassley (R-Iowa) pledged in a joint letter to extend the provisions retroactively as soon as possible. We’ve become used to the annual extension of the AMT patch, but Congressional procrastination this year led to a number of other taxes winding up in limbo, most notably the inheritance tax, which effective Jan. 1 has been repealed for 2010. Don’t celebrate yet – Democrats have promised to resurrect it retroactively.

Other tax breaks that expired New Year’s Eve:

– the deduction for state and local sales tax for those who itemize

– the extra $1,000 deduction for real inheritance taxes for filers who claim the standard deduction

– the $4,000 deduction for college tuition

– the Research & Development credit for companies – which has been extended 13 times since 1981 without Congress making it permanent

Congress has made such a habit of leaving taxpayers guessing by letting tax breaks lapse and then issuing temporary patches that such tax law provisions have become known as “extenders,” according to Forbes. Rather than making a decision to eliminate them or make them permanent (and thereby recognize their actual costs), Congress continually extends them until the patch itself becomes the rule, rather than the exception.

Your tax situation can impact your overall investment plans, and vice versa. With so many pieces of the tax puzzle in limbo, it’s more important than ever that you consider the assistance of a professional tax advisor and estate planning attorney do to help you stay abreast of tax law changes that may impact you. We are happy to work closely with your accountant and attorney to assist you in developing plans for your personal situation. Call us to schedule a joint appointment.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Morgan Stanley Capital International Europe, Australia and Far East Index (MSCI EAFE Index) is a widely recognized benchmark of non-U.S. stock markets. It is an unmanaged index composed of a sample of companies representative of the market structure of 20 European and Pacific Basin countries and includes reinvestment of all

dividends. Barclays Capital Aggregate Bond Index is an unmanaged index comprised of U.S. investment-grade, fixed-rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and 10 years. Written by Securities America. SAI# 302365