Stock Market Commentary

For the week of January 18, 2010

The Market

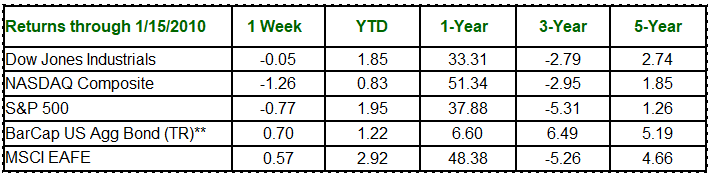

The Dow and S&P rose to their highest levels in over a year on Thursday, ending the day at 10,710.55 and 1,148.46, respectively. Investors received mixed news as companies began issuing quarterly earnings reports, with JPMorgan Chase announcing heavy mortgage and credit card loan losses. Disappointing reports on retail sales and consumer sentiment also contributed to market declines for the week. For the week, the Dow lost 0.05 percent to close at 10,609.65. The S&P fell 0.77 percent to finish at 1,136.03, and the NASDAQ dropped 1.26 percent to end the week at 2,287.99.

Fat Fed – The Federal Reserve generated a $45 billion profit for 2009, money that goes back into the U.S. Treasury. According to a Jan. 11 report in the Washington Post, the Fed had the highest earnings in its 96-year history. The largest previous profit was $34.6 billion in 2007. The Fed’s earnings for 2009 exceed those of most financial institutions, “easily topping the expected profits of Bank of America, Goldman Sachs and JPMorgan Chase combined,” the Post said. Most of the Fed’s earnings came from buying bonds to hold down interest rates and stimulate the economy. The Fed owned $1.8 trillion in U.S. government debt and mortgage-related securities at the end of 2009, compared to $497 billion a year ago. (Source: Washington Post).

No Bank Bonus – Despite the Federal Reserve earning a record $45 billion profit in 2009, Chairman Ben S. Bernanke will receive no bonus. He did receive a small cost-of-living increase, bringing his salary to $199,700. (Source: Washington Post).

Flat Inflation – The consumer inflation rate rose just 2.7 percent in 2009, according to a Labor Department report issued Jan. 15. The decline in food costs offset increases in energy prices. The Consumer Price Index rose just 0.1 percent in December. The Labor Department reported separately that inflation-adjusted weekly wages for the year declined 1.6 percent, the largest drop since 1990.

WEEKLY FOCUS – Donor-Advised Fund Channels Dylan

In an apparent first for the music business, the international royalties from Bob Dylan’s “Christmas in the Heart” album will be channeled into a donor-advised fund benefiting Crisis of London, a British charity that provides meals to the homeless, according to CAFAmerica, the company that established the fund.

A donor-advised fund, according to the IRS, is an account maintained and operated by a 501(c)(3) nonprofit organization, referred to as the sponsoring organization. Each account is funded by contributions from individual donors. The sponsoring organization has legal control over the accounts, but the donor is allowed to advise on the investment of the assets, which can include cash, securities and even art, and the distribution of funds.

According to an April 22, 2009 article in the Wall Street Journal, donor-advised funds can cost significantly less to maintain than private foundations and are not required to make distributions as often as a foundation. The National Philanthropic Trust reported that the number of donor-advised funds rose 11 percent in 2008, after a 13 percent increase in 2007.

In addition to a lower maintenance cost, a donor-advised fund may offer additional advantages over a private foundation, including a higher limit for deducting contributions, a lack of taxes on investment gains, and no requirement to make annual distributions. Also, the tax forms for donor-advised funds are not made public, as foundation returns are, allowing donors to retain their privacy.

Donor-advised funds may have disadvantages as well, including relinquishing control of contributions. The sponsoring organization is not required to act in accordance with the donor’s wishes, although such a situation is rare, according to the Wall Street Journal. Also, the donations are irrevocable and must be used for a qualified charitable organization.

Before selecting any vehicle for fulfilling your philanthropic plans, you should consult with your tax professional and estate planning attorney. Because your charitable gift planning may impact your retirement investment and income distribution plans, we are happy to work with your other professionals to ensure a cohesive plan. Call our office to schedule a joint appointment.

* The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Morgan Stanley Capital International Europe, Australia and Far East Index (MSCI EAFE Index) is a widely recognized benchmark of non-U.S. stock markets. It is an unmanaged index composed of a sample of companies representative of the market structure of 20 European and Pacific Basin countries and includes reinvestment of all dividends. Barclays Capital Aggregate Bond Index is an unmanaged index comprised of U.S. investment-grade, fixed-rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and 10 years. Written by Securities America. SAI# 302678